Institutional Real Estate… Now Enabled for Resale

USREM (US Real Estate Market) is a private platform designed for institutional investors, family offices, and professional individual investors to access exclusive, off-market real estate investment opportunities.

Our innovative marketplace enables investors to buy–and sell–limited partnership interests in residential and commercial real estate properties.

Join USREM today for immediate access to our collection of opportunities.:

or

Schedule a call right now:

Established General Partners

USREM works with experienced sponsors with established track records to ensure the highest quality asset selection and property management.

Institutional Quality Real Estate

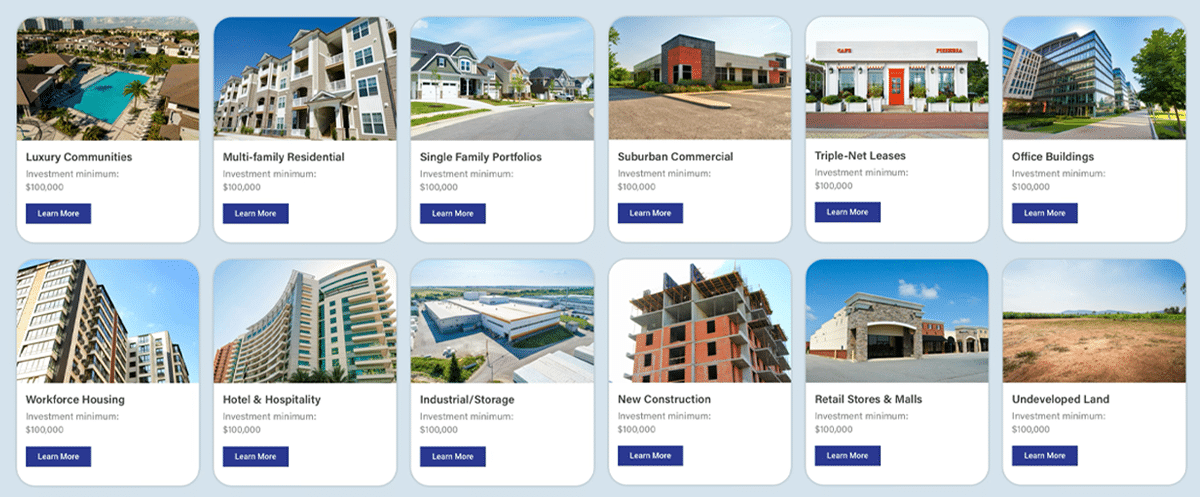

The high-quality assets available through the USREM platform include a wide range of opportunities, from large multi-family rental properties, to office buildings, student housing, single-asset triple net leased retail, and affordable housing. The minimum investment size is $250,000, and trophy asset opportunities as large as $50,000,000 are available. USREM is backed by some of the biggest names in real estate, and we leverage our network to deliver institutional quality assets to further your investment objectives.

Resellable Interests

All assets purchased through the USREM platform—whether in a primary or secondary transaction—are resale-enabled. As a Limited Partner, you are pre-approved to exit on your timetable, not the sponsor’s (subject only to regulatory holding requirements). Savvy investors can also use the platform to seize opportunities on the secondary market, sometimes at a discount to Net Asset Value.

Exclusive and Off-Market Opportunities

We use our decades of relationships to source opportunities you won’t find anywhere else, including the ability to purchase investments in properties and funds that are closed to new investors.

Built for the Underserved “Middle Market”

Retail has public REITs. The biggest players benefit from economies of scale in purchasing entire properties. Meanwhile, the middle market has traditionally paid high fees for limited access to passive investment opportunities. USREM offers the best of all worlds: direct access to institutional-quality assets, competitive fees, and the opportunity for liquidity.

USREM works with your investment advisors and wealth managers

USREM Securities LLC is an SEC registered broker/dealer, and will work with your team of Registered Investment Advisors and wealth managers to find appropriate investments for your specific goals, know that you have the potential opportunity to flexibly re-balance your real estate portfolio as desired

Are you an RIA? Develop custom real estate portfolios with USREM

USREM actively works with RIAs to help construct customized portfolio solutions for your client’s particular needs, including developing customized interfaces to bring selected opportunities directly onto your own platform. And if you are a real estate professional interested in creating an open-ended fund, USREM can work with you to support both sides of your transactions.

Are you a Sponsor or General Partner of a real estate syndicate or fund?

Working with USREM enables you to capture the liquidity premium for your eligible syndicates and funds. Giving your limited partners the opportunity to confidentially exit or enter on their own schedule, without in any way affecting the fund or the other partners, enables you to create longer syndicates and evergreen funds at little to no cost. All participants on the USREM platform are screened for regulatory and financial compliance before being introduced to you, and working with USREM is an excellent way to expand your Limited Partner base of Qualified Purchasers.